Ask for a stamped copy of the Answer from the Clerk of Court. Whilst it may seem like a good idea at the time to use a credit card or overdraft to help get you all the way to payday in fact you could be making the problem a whole lot worse.

The Art Of Debt Guerrilla Warfare How To Beat Debt Collectors When Your Back Is Against The Wall

The Art Of Debt Guerrilla Warfare How To Beat Debt Collectors When Your Back Is Against The Wall

Top 5 tips for beating debt 1 Review your financial situation.

How to beat debt. If your budget plan shows that you have a problem its vital you know which debts to deal with. Pay off your loans and stay out of debt for the long run Build savings that will see you through thick and thin Avoid financial disasterfrom bad credit deals to outright scams Start building a safe smart investing portfolio. Sometimes settling for 30 or less.

This is how to pay them off sensibly or have them forgiven entirely. With debt consolidation you take all your current debts and consolidate them into one single debt with a single monthly payment. Debt returns have been rather depressed with rates plunging to record lows.

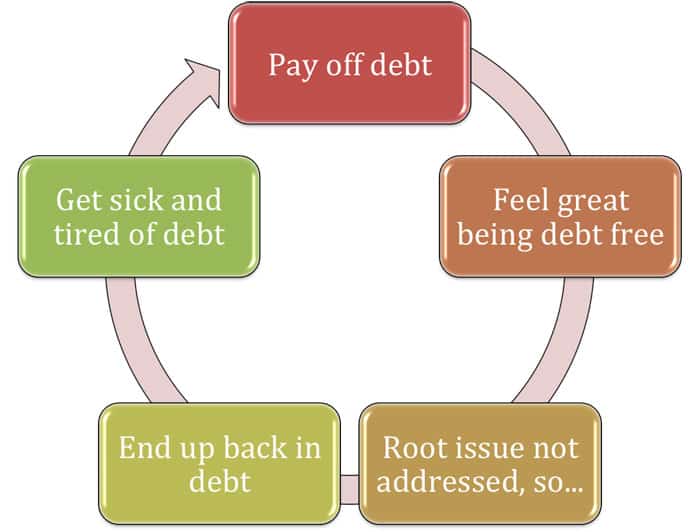

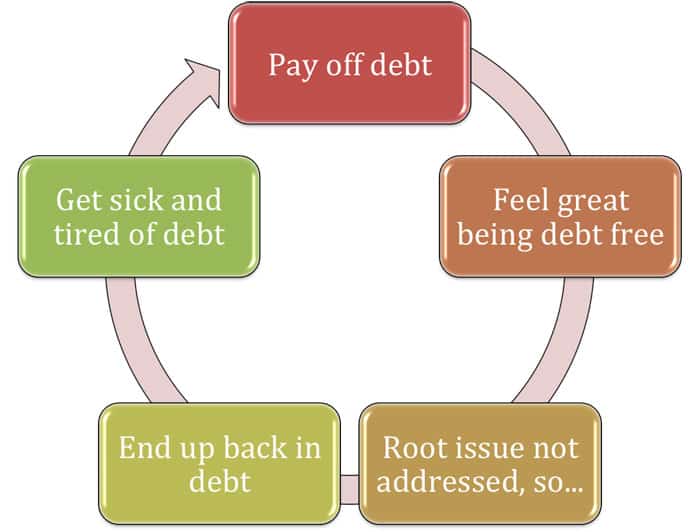

Avoid the debt trap. One way to do this is to buy into MLDs market-linked debentures now offered by the likes of Piramal Finance or Shriram Transport Finance. Its common sense to pay debt off as quickly as possible but it can also help you avoid debt fatigue.

With proper planning and control you can beat debt and get yourself back in the black. Getting out of debt isnt easy and beating it completely can take years. These groups try to get debt from you by sending letters asking you to pay or agreeing repayment plans with you.

However it can be done. When you do negotiate at the 6 or 7 month period you can settle for a lot less than 100 of the debt. Keep in mind when you are sued by a debt.

For a debt to be legally collectable the debt collector must produce documentation showing that you signed an agreement to pay that the debt was legally sold to the collector and that the amount and debt source in question are both legal and valid and not past a statute of limitations for collection. Saving a little every day can go a long way. Force the creditor to prove the debt and your responsibility for it.

Eliminating that extra 150 coffee each workday can mean over 400 a. A debt collection lawsuit is initiated when a debt collector like Javitch Block files a Complaint alleging that you owe a specific amount of money. Feeling anger towards your debt is useful only if you funnel that anger into a clear and direct plan.

Reduce small recurring expenses. Attack the smallest debt with a vengeance while making minimum payments on the rest of your debts. 3 Check what youre entitled.

Although debt always feels heavy its good to go in knowing that the first three years are likely your best bet at repayment. File the Answer with the Clerk of Court. There are many different forms of debt consolidation including balance transfer credit cards personal debt consolidation loans and debt.

Let the anger drive you to action not to destruction. Credit card companies want you to pay the minimum amount but you dont want to do that because. Good examples of ways you can save on costs include taking public transit instead of your car bringing your lunch to work and reducing your coffee consumption.

On the one hand there are debt collection agencies that buy debt from others or collect debt on the behalf of other companies. How can you beat that debt. Tens of millions of Americans have more than 15 Trillion in outstanding student loans.

Look Baby Step 2 takes a few months to finish for some people and a few years for others. 2 Tackle your debts. Here are ten things you can do to help your situation.

Commit to paying over the minimum balance. Before you decide on the best way to sort out your finances get as much financial. 5 If the collection agency will not budge then hang up and wait another 2 or 3 months.

Once you pay off the smallest debt take that payment and apply it to your next-smallest debt. Some tips for doing so include. Repeat this method as you plow your way through debt.

When you receive the Complaint you are presented with the opportunity to file an Answer where you can refute the allegations in the Complaint along with highlighting some of the glaring deficiencies in the lawsuit. You always want to try to pay more than the minimum balance you owe per month. They have very limited powers but can take the debt to court to get their money if you ignore them.

So how does one earn more from this asset class at least more than the headline inflation rate. Dont admit liability for the debt. Let the anger prevent you from feeling like a victim but instead empower you to solve the problem.

Especially if your debt is a loan in which interest doesnt start accumulating for a set amount of time.

How To Beat Debt Your Guide To Getting Out Of Debt Are You In Debt If You Are Like The Typical American Then Y Get Out Of Debt Debt Paying Off

How To Beat Debt Your Guide To Getting Out Of Debt Are You In Debt If You Are Like The Typical American Then Y Get Out Of Debt Debt Paying Off

How To Beat Debt On A Low Income

How To Beat Debt On A Low Income

How To Deal With Debt Collectors And Win Every Time How To Beat Them

How To Deal With Debt Collectors And Win Every Time How To Beat Them

Mastering Money How To Beat Debt Build Wealth And Be Prepared For Any Financial Crisis Amazon De Champ Norm May Marlin Fremdsprachige Bucher

Mastering Money How To Beat Debt Build Wealth And Be Prepared For Any Financial Crisis Amazon De Champ Norm May Marlin Fremdsprachige Bucher

Mastering Money How To Beat Debt Build Wealth And Be Prepared For Any Financial Crisis Norm Champ 9781260452532

Mastering Money How To Beat Debt Build Wealth And Be Prepared For Any Financial Crisis Norm Champ 9781260452532

Beat Debt Collections Legally Www Beatcollections Com

Beat Debt Collections Legally Www Beatcollections Com

How To Deal With Debt Collectors And Win Every Time How To Beat Them

How To Deal With Debt Collectors And Win Every Time How To Beat Them

How To Beat Debt Collectors At Their Own Game Khou Com

How To Beat Debt Collectors At Their Own Game Khou Com

Tricks To Beating Debt Payoff Burnout How To Get Out Of Debt Fast And Then We Saved

Tricks To Beating Debt Payoff Burnout How To Get Out Of Debt Fast And Then We Saved

Mastering Money How To Beat Debt Build Wealth And Be Prepared For Any Financial Crisis In Apple Books

Mastering Money How To Beat Debt Build Wealth And Be Prepared For Any Financial Crisis In Apple Books

Beat Debt Collectors At Their Own Game A Legal Guide To Stop Harassment Lawsuits Garnishments Kindle Edition By Soto Carl Professional Technical Kindle Ebooks Amazon Com

Beat Debt Collectors At Their Own Game A Legal Guide To Stop Harassment Lawsuits Garnishments Kindle Edition By Soto Carl Professional Technical Kindle Ebooks Amazon Com

How To Beat Debt Your Guide To Getting Out Of Debt Compounding Pennies

How To Beat Debt Your Guide To Getting Out Of Debt Compounding Pennies

How To Deal With Debt Collectors And Win Every Time How To Beat Them At Their Own Game Your Number One Guide To Beating Debt Collectors English Edition Ebook Braveboy Ernie Amazon De

How To Deal With Debt Collectors And Win Every Time How To Beat Them At Their Own Game Your Number One Guide To Beating Debt Collectors English Edition Ebook Braveboy Ernie Amazon De

Beat Bad Debt With Good Advice Intelligenthq

Beat Bad Debt With Good Advice Intelligenthq

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.