Lump Sum Financial Payout Rates. However the two types of payments have some fundamental differences and if.

Should You Take The Annuity Or The Lump Sum If You Win The Lottery

With the annuity the winner gets 15 billion parsed out in slowly increasing annual intervals beginning at 22 million and ending at 92 million paid 30 years down the line.

Take lump sum or annuity lottery. As an old person you can still choose the annuity lottery payment because even in the event of death before the annuity lottery payment is complete your heirs get to inherit it. The interest rate is critical in determining whether a lump sum is a better deal than an annuity. Powerball and Mega Millions offer winners a single lump sum or 30 annuity payments over 29 years.

Figuring out whether to take a lump sum or an annuity from a lottery is a great problem to have. Dont opt for the annual payout or so-called annuity lottery payments. The lump sum is the better deal assuming you dont blow most of the money in a hurry and invest at least a big chunk of it instead.

The Mega Millions also offers lump sum payouts and annuities however the distribution of the annuity is slightly different. This helps insure against blowing through all the money in a short time while allowing the winner access to a big pot of money. While the Powerball winnings can be paid out in an annuity to family members should the winner die other lotteries will simply stop payments.

A lump-sum payout distributes the full amount of after-tax winnings at once. Annuity payments When you take a lump-sum payment its typically a smaller amount than the reported jackpot. Making a Savvy Investment.

The argument is that choosing an annuity lifetime income stream will never beat a well-planned asset-allocated portfolio. If you are not keen on taking your lottery winnings in the form of annuity payments you can choose to receive your winnings in the form of a cash lump sum. State lottery agencies say the lump-sum option is fair because you can get the advertised.

Lump-Sums Versus Annuity Payments To illustrate how lump-sum and annuity payments work imagine you won 10 million in the lottery. Lottery winners can collect their prize as an annuity or as a lump-sum. Before we get into the reasons why its better to take the lump sum lottery winnings lets first address the glaring reality.

Winners can accept a one-time cash payout. If you choose the lump sum rather than the extended payout you will get much less money than. According to our research if you invest it all and if you can obtain an annual return of more than between 3 and 4 the lump sum makes sense over the annuity 30 years down the line.

If the winner is older the lump sum option may be the better choice. The other more popular possibility is a fat one-time lump sum of 930 million. If youre receiving a large sum of money from your pension plan or lottery winnings its important to analyze both payout options before choosing the lump sum or annuity.

If you took the entire winnings as a lump-sum payment the entire winnings would be subject to income tax in that. In theory that is true but life is rarely lived in theory. Your odds of winning a jackpot lottery are slim to impossible.

Often referred to as a lottery annuity the annuity option provides annual payments over time. This means the net earnings can be considered higher. Common wisdom from financial pundits planners and stock market experts is that you should always take the lump sum if you win the lottery.

Lottery Annuity vs. Ultimately it comes down to whether youd like to get a whole lot of free money right now or a lot of free money every year for a long time. And unlike an annuity thats purchased the lottery annuity doesnt charge the recipient fees.

If you ever find yourself the winner of a large lottery opt for the lump sum lottery winnings. However as with annuity payments it has its own unique pros and cons. This is often the preferred option for lottery winners because it allows access to staggering amounts of cash incredibly quickly.

The trade-offs of lump-sum vs. Powerball offers winners a lump-sum payout or an annuity option where the payout would be distributed over the course of 29 years and 30 payments. No lottery winner is going to save and invest all of their winnings of course.

Lottery winners in general both young and old prefer to take the lump sum lottery payout option. Still some advisors recommend taking the lump sum and using some of it to purchase an annuity from a private company. With a Mega Million annuity you are offered the initial payment upon.

While an annuity may offer more financial security over a longer period of time you can invest a lump sum which could offer you more money down the road. In the case of the 202 million jackpot the winner could take 1422 million in cash. The assumption underlying most annuities is that money is constantly productive that is there is a time-value to money represented mathematically as the interest rate.

Why You should choose an Annuity lottery instead of lump sum. The math is fairly clear on whether lottery winners should take the annuity or lump sum. For pensions unlike lotteries annuities are not adjusted for inflation or.

Good Question Powerball Take The Lump Sum Or Annuity Youtube

How Lottery Winners Gain Choosing Annuity Over Lump Sum

Dear Powerball Winner Take Our Advice And Take The Annuity The New York Times

Canadian Lottery 1000 Week For Life Vs 780k Lump Sum Over 60 Years Invested Oc Dataisbeautiful

Winning The Lottery Take The Lump Sum Or The Annual Payments

Lottery Prize Should You Take The Annuity Or The Lump Sum

Should You Take The Annuity Or The Lump Sum If You Win The Lottery

Won The Lottery Take The Lump Sum Or Annuity Quiz

So You Ve Won Mega Millions Do You Choose The Lump Sum Or The Annuity Oc Dataisbeautiful

Annuity Or Lump Sum What Is The Best Lump Sum Or Annuity Youtube

Powerball S Big Bait And Switch

Lottery Winnings Tax Can Taxes Be Lowered When Selling Lottery Payments

Which Is More Profitable For Lottery Organizers If The Winner Takes Lum Sum Or Annuity Option Quora

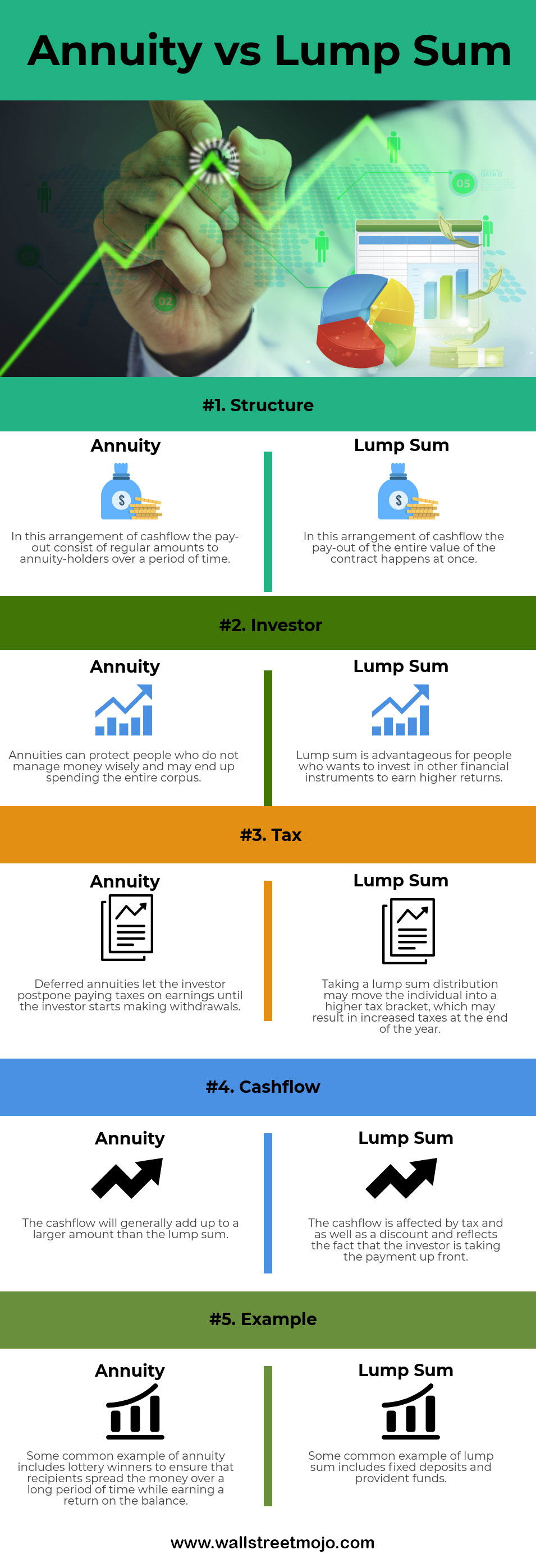

Difference Between Annuity And Lump Sum Payment Infographics

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.