Key Reason Never Retiring as outlined in How to Successfully Never Retire is Easily Achieved and Far More Rewarding. Pre-retirement you had your routine down pat.

Getting Ready To Retire Five Years From Now Infographic

Getting Ready To Retire Five Years From Now Infographic

Create a mock retirement budget.

How to retire now. In answering Jims question I want to retire now. Theres an emotional process that most people go through when adjusting to. If 4 sounds too low consider that youll take an income that increases with inflation.

You could sell the big house and move to a cheaper community in the United States. Consider a variety of options for where you want to retire from dream locations to maintaining your current situation. Science says 51 percent of US.

If inflation is 2 per year youd withdraw 40800 in your second year 41616 in the third year and. Determine what kind of lifestyle you want in retirement. While giving back can mean boosting charitable contributions for a growing number of retirees it often comes in the form of a significant volunteer position or encore career notes Friedman.

One million dollars is a big figure to aim for. Compose a list of places youre considering retiring. Research indicates that those who are happiest in retirement tend to answer that question by giving back and discovering a sense of purpose.

Make a tiered list that includes dream locations easily attainable or alternative dream places. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features. Youre eligible to claim Social Security payments beginning at age 62.

Decide When to Start Social Security. Youll be able to cover all of your needs without much issue providing you with. 8 Tips for Adjusting to Retirement Expect to Go Through Stages of Emotions.

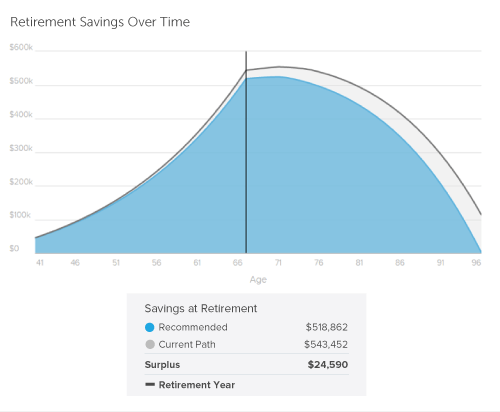

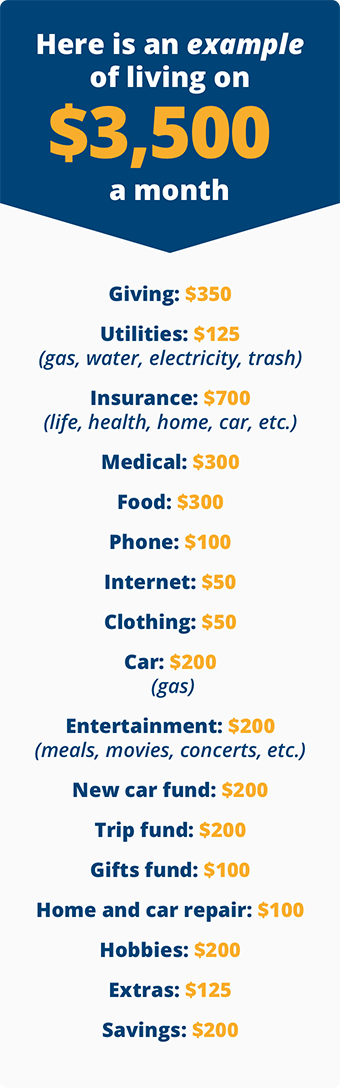

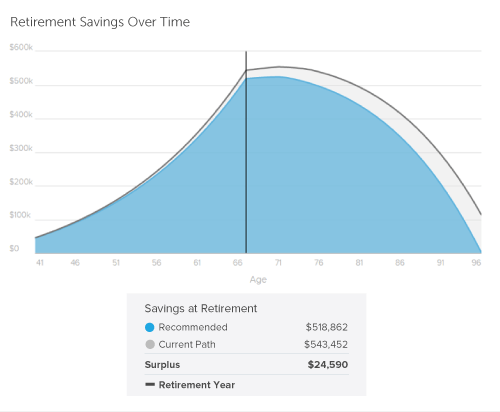

Medicare coverage begins at age 65 regardless of your Social. Jim currently spends 3500 a month 42000 annually in expenses to maintain his lifestyle and is determined to continue to live the same way in retirement. If you can manage it get a job that offers benefits such as paid leave which may allow you to splurge on activities such as travel on occasion.

That income typically comes from Social Security pensions 401ks IRAs and. To retire sooner maybe even for example right now rather than later you have to remove yourself from a high-cost high-tax lifestyle. So if you retire at 60 the money should ideally last through age 90.

One way to retain a semblance of this lifestyle and sustain retirement without savings is to work a part-job in retirement that helps pay for essential expenses but still leaves you with time for other pursuits you had in mind for retirement such as volunteering. Evaluate your current financial situation. Have you ever wished you could join an exclusive club.

Sign Up for Medicare or Other Health Insurance. In addition there are several steps to determine if you can afford to retire. Just like retiring early reduces benefits retiring later increases them.

As a general rule retirees may need about 75 of their pre-retirement income to enjoy a comfortable retirement. To find out how much you need before you can retire use a calculator to estimate Social Security benefits then subtract that number from expected annual. Those born after 1943 can expect an eight percent increase for each year they wait to claim benefits after full retirement age.

Estimate your total annual spending including periodic expenses like dental work and home repairs. Alarm goes off shower. Add up all of your potential sources of income in retirement.

You could move to your cottage on the lake and travel during the winter. What floated to the top can be summarized in one distinct sentence. How about income equal to a millionaire - what does that look like.

Retiring at 62 would mean a permanent reduction of almost 30 percent to your Social Security benefits compared to what they would be if you waited until your full retirement age. The answer depends on your financial situation but if youre serious about learning how to retire early there are some things you need to do. Typically if you can access around 55276 a year in retirement income you can retire well in New Mexico.

Employees are quitting their jobs right now. Heres what to do if you are planning to retire this year. If you retire with 500k in assets the 4 rule says that you should be able to withdraw 20000 per year for a 30-year or longer retirement.

Creative Ways To Retire Early Consumer Credit Early Retirement Retirement Quotes Retirement

Creative Ways To Retire Early Consumer Credit Early Retirement Retirement Quotes Retirement

How Much Singaporeans Need To Save Now To Retire At 55 Or 62 Years Old

How Much Singaporeans Need To Save Now To Retire At 55 Or 62 Years Old

What You Need To Do Now To Achieve Early Retirement Retirement Planning How To Plan Investing

What You Need To Do Now To Achieve Early Retirement Retirement Planning How To Plan Investing

Best Retirement Calculator 2021 See How Much You Ll Need Smartasset

Best Retirement Calculator 2021 See How Much You Ll Need Smartasset

Here S Your Plan To Retire In Ten Years Sparx Finance

Here S Your Plan To Retire In Ten Years Sparx Finance

How To Make Your Money Last Completely Updated For Planning Today The Indispensable Retirement Guide Quinn Jane Bryant 9781982115838 Amazon Com Books

How To Make Your Money Last Completely Updated For Planning Today The Indispensable Retirement Guide Quinn Jane Bryant 9781982115838 Amazon Com Books

Surprise It S Retirement Time Landsberg Bennett

Surprise It S Retirement Time Landsberg Bennett

/saving-for-retirement-with-a-late-start-38e3bb030ef242649b53f1ad16826b10.png) 7 Tips For Saving For Retirement If You Started Late

7 Tips For Saving For Retirement If You Started Late

How To Retire Early Ramseysolutions Com

How To Retire Early Ramseysolutions Com

Best Retirement Calculator 2021 See How Much You Ll Need Smartasset

Best Retirement Calculator 2021 See How Much You Ll Need Smartasset

Start Planning For Your Retirement Right Now How To Save Money How To Plan Financial Freedom Quotes Retirement Wishes

Start Planning For Your Retirement Right Now How To Save Money How To Plan Financial Freedom Quotes Retirement Wishes

How To Figure Out How Much You Need To Save For Retirement

How To Figure Out How Much You Need To Save For Retirement

Amazon Com Retirement 2 In 1 Book Retirement Learn How To Retire Early And Wealthy Make More Money Now Proven Strategies To Quickly Make Extra Income Ebook Gardner Robert Kindle Store

Amazon Com Retirement 2 In 1 Book Retirement Learn How To Retire Early And Wealthy Make More Money Now Proven Strategies To Quickly Make Extra Income Ebook Gardner Robert Kindle Store

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.