Federal funds effective rate determines the interest rate paid by depository institutions such as banks and credit unions who lend reserve balances to. Prior to March 1 2016 the EFFR was a volume-weighted mean of rates on brokered trades.

Why The Federal Reserve Cut Interest Rates The New York Times

Why The Federal Reserve Cut Interest Rates The New York Times

Daily Treasury Bill Rates.

Us federal interest rate. Federal Reserve System FED The central bank of the United States is the FED. 69 rindas The Federal Open Market Committee FOMC meets eight times a year to. Fed Funds Rate Current target rate 000-025 025 What it means.

The interest rate at which banks and other depository institutions lend. This page provides the latest reported value for - United States Fed Funds Rate - plus previous releases historical high and low short-term forecast and long-term prediction economic. On its H15 statistical release Selected Interest Rates the Board reports the prime rate posted by the majority of the largest twenty-five banks.

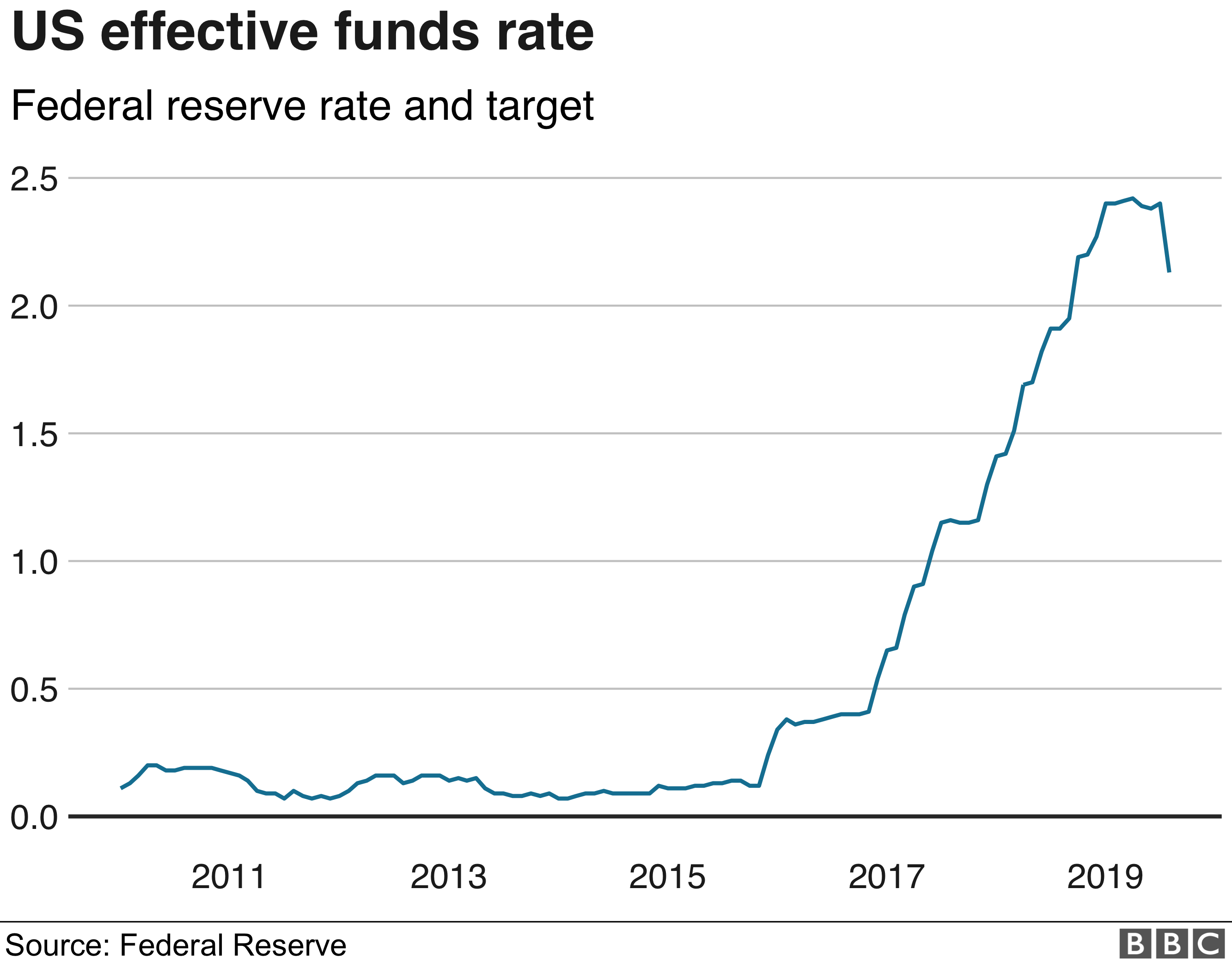

The Fed has maintained its target interest rate at 0 to 025 since March 15 2020 in response to the COVID-19 pandemic. Learn what to expect next. The current American interest rate FED base rate is 0250 Note.

Every commercial bank has a reserve that is required to be kept at Federal Reserve Banks - if a bank has more deposits than it needs it can lend to another bank that has a shortfall. The US Federal Reserve interest rate or the Fed Funds Rate is the rate at which commercial banks in the US lend to each other overnight. 26 rindas These rates known as Applicable Federal Rates or AFRs are regularly published.

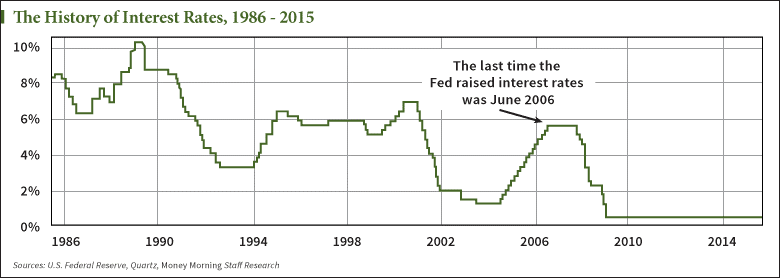

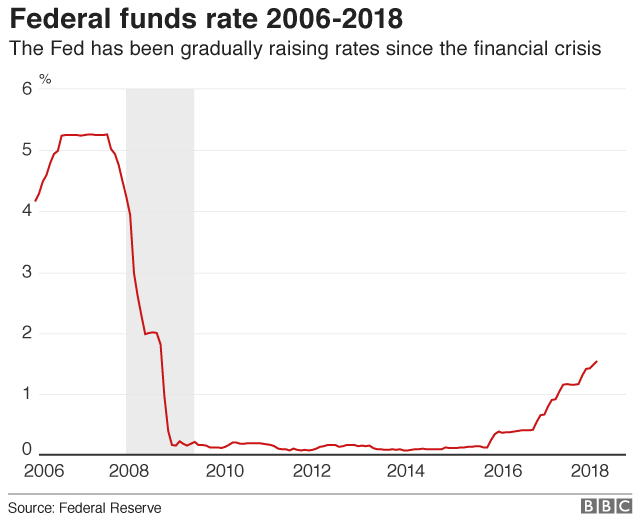

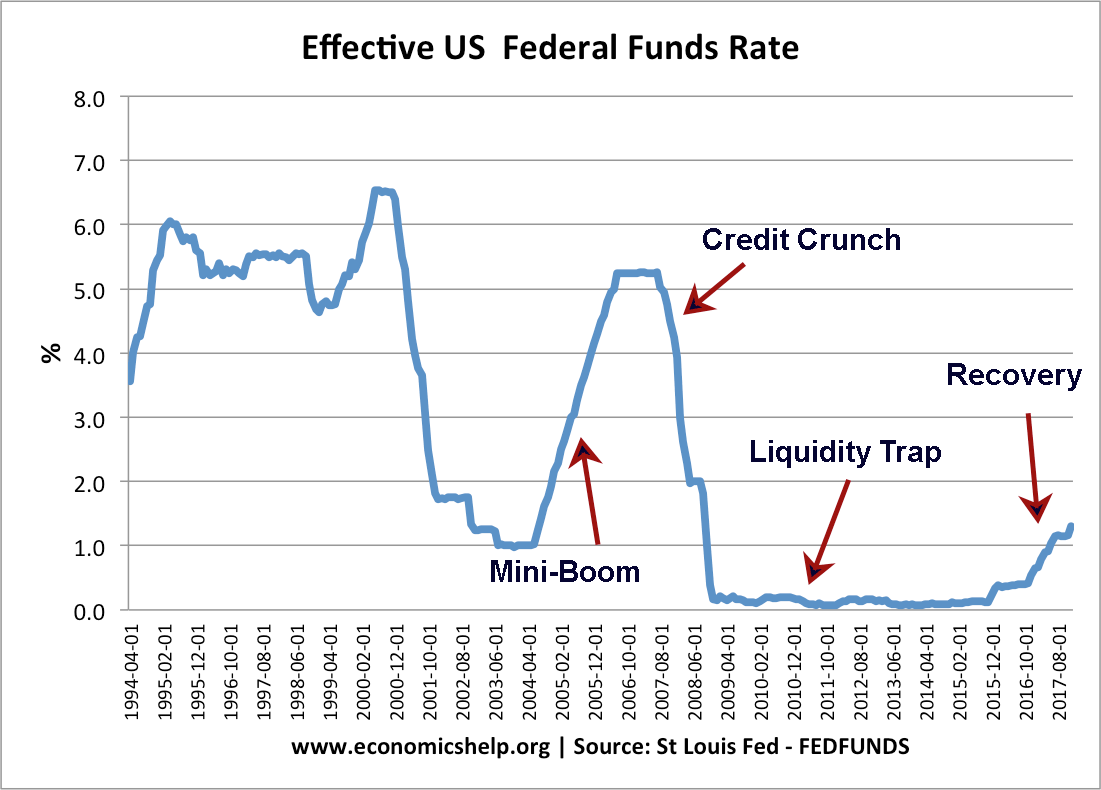

The last full cycle of rate increases occurred between June 2004 and June 2006 as rates steadily rose from 100 to. As of March 1 2016 the daily effective federal funds rate EFFR is a volume-weighted median of transaction-level data collected from depository institutions in the Report of Selected Money Market Rates FR 2420. It is often used as a reference rate also called the base rate for many types of loans including loans to small businesses and credit card loans.

Federal Student Aid. Therefore the United States Prime Rate remains at 325 The next FOMC meeting and decision on short-term interest rates will be on June 16 2021. The Federal Reserve cuts rates again An emergency rate cut setting the new benchmark interest rate range between 0 and 025.

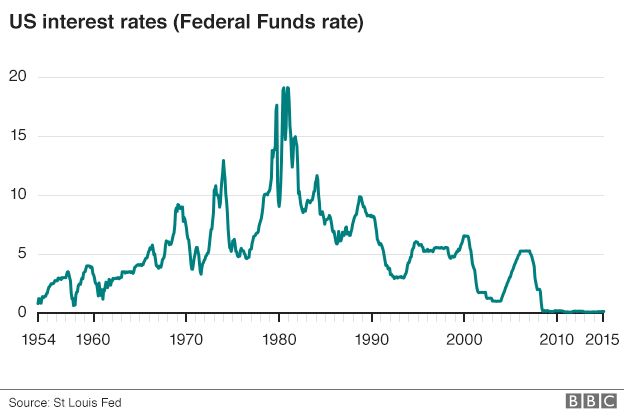

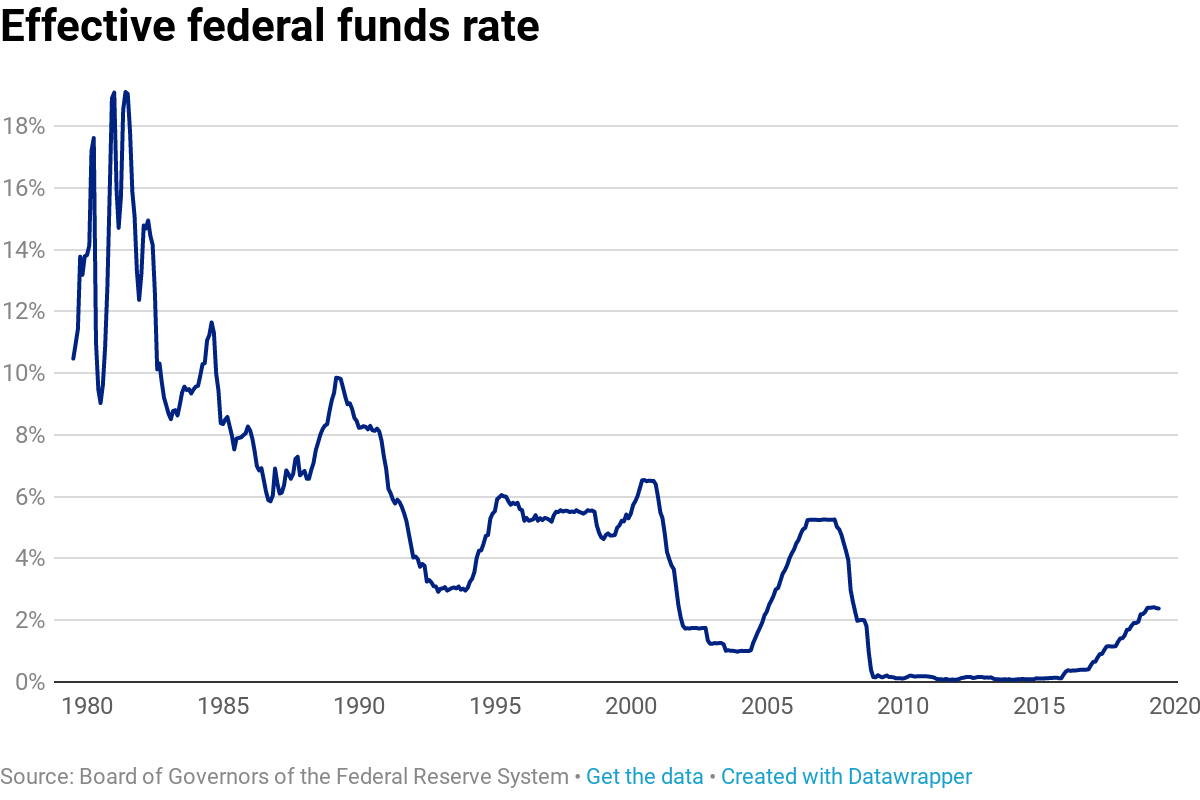

In the United States the authority to set interest rates is divided between the Board of Governors of the Federal Reserve Board and the. Interest Rate in the United States averaged 552 percent from 1971 until 2021 reaching an all time high of 20 percent in March of 1980 and a record low of 025 percent in December of 2008. These rates are composites of closing market bid quotations on recently issued Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 330 PM each business day.

Prime Rate is a commonly used short-term interest rate in the banking system of. At this time the FED has adopted an interest rate range of 000 to 025. As of March 15 2020 the target range for Federal Funds Rate is 000025 a full percentage point drop less than two weeks after being lowered to 100125.

Investors were unimpressed with the move however and US stock market futures tumbled on the news hitting their daily down limit of 5 shortly after trading began. The prime rate is an interest rate determined by individual banks.

Us Rate Rise Why It Matters Bbc News

Us Rate Rise Why It Matters Bbc News

Why The Fed Lowered Interest Rates Again The New York Times

Why The Fed Lowered Interest Rates Again The New York Times

Chart U S Interest Rate History Since 1986

Chart U S Interest Rate History Since 1986

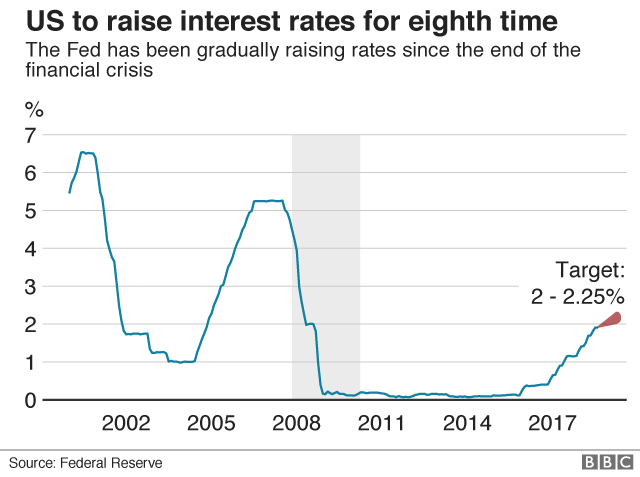

Fed Announces Us Rate Increase Bbc News

Fed Announces Us Rate Increase Bbc News

Us Interest Rates Federal Funds Rate 1990 2017 Download Scientific Diagram

Us Interest Rates Federal Funds Rate 1990 2017 Download Scientific Diagram

Effective Federal Funds Rate Fedfunds Fred St Louis Fed

Effective Federal Funds Rate Fedfunds Fred St Louis Fed

Why The Fed S Interest Rate Move Matters Bbc News

Why The Fed S Interest Rate Move Matters Bbc News

Conversable Economist Facing The Long Term Problem Of Low Interest Rates

Conversable Economist Facing The Long Term Problem Of Low Interest Rates

Federal Reserve Raises Interest Rates Again Bbc News

Federal Reserve Raises Interest Rates Again Bbc News

Us Federal Reserve With The Third Interest Rate Hike This Year

Here S How The Fed Sets Interest Rates And How That Rate Has Changed Over The Last Four Decades

Here S How The Fed Sets Interest Rates And How That Rate Has Changed Over The Last Four Decades

Interest Rate Cycle Economics Help

Interest Rate Cycle Economics Help

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.